Bruges Group Blog

The Need for an Income Tax Rate and Corporate Tax Rate Cut

Professor Patrick Minford and The Bruges Group are rightly calling to:

- Cut corporation tax by 10%: £32 billion

- Abolish the very top additional 5% rate: £1 billion

- Cut the top rate of income tax to 30%: £15 billion.

- Cut the standard rate of income tax by 5%: £28 billion.

The history of tax cuts in the United States demonstrates why these proposals will be extremely beneficial to the British economy.

The Case for an Income Tax Rate Cut

The conventional view is that the Eisenhower years (1953-1961) were one of economic prosperity. There were some notable expansions of prosperity, for example the number of single family homes increased by 11 million, lots of TVs, appliances and cigarettes were being purchased, spending on sports, recreation and travel was at a high level and people spent 1/4th more of their money than was the case at the beginning of the decade and "advertising came into its own, accounting for $10 billion of the national economy."

However, recessions were constantly recurring and as time went on this prosperity was shared by a diminishing percentage of the population. In the period from 1949-1969, the US economy fell into recession no less than four times. The country was hit with a recession in 1948-1949 where unemployment rose to 4 million. A recession hit again in 1953-1954 where unemployment rose to 4 million once more with an additional half a million who stopped looking for work. In 1957-1958, recession hit again, and this time unemployment rose to higher than 5 million. And again in 1960-1961 where unemployment reached the 5 million mark again. 4 recessions in just 11 years. Even the average long-term growth rate around the "boom and busts" was lacklustre, 2.3% per year which was barely enough to clear the growth in population by 1.7%. For instance, from the 1957 economic peak to 1960, the private sector only grew at a rate of 1.5% while government grew by 4.3% per year.

"What was holding back the economy so persistently in the 1950s and 1960s?" The answer lies in tax rates. In this period the top federal tax rate was 91%. If you were in this bracket you had to give 91 cents out of every dollar you made above a certain threshold. It wasn't just the very rich who had to suffer high tax rates as there were twenty-four other brackets. "Every time you made a little more money, your extra earnings - even if just for a cost-of-living increase to keep up with inflation - were taxed at the highest rate your income had been subject to before, or your raise threw you into an even higher bracket."The first bracket had a rate of 20% started at $700 which is equivalent to $5600 today. Rates then increased by a few percentage points with every couple thousands of dollars in additional income, for example 22%, 26%, 30 % till the final rate of 91%. President Kennedy began a process of changing these punitive rates.

The final legislation reduced the rates of the 24 income tax brackets from the range of 20%-91% to a range of 14%-70%. One more bracket was added for low income earners so that they would be hit less hard by progressivity. Also, the maximum corporate tax rate was reduced from 52% to 48% at the top with bigger rate cuts for smaller companies. The result of this was a reduction in the frequency of recessions and the sustenance of a continuous, high growth rate. From 1961-1969, 16 million new jobs were created compared to 3.5 million in the Eisenhower years and the expansion lasted 106 months which was the longest expansion in American history at the time. Median income increased at a rate 50% higher than in the previous eight years. Businesses started springing up at a rapid pace compared to the 1950s where the failure rate was the same as the start-up rate. "The ratio of businesses opening up to those folding leaped by nearly a third." The tax cuts let capital flow out of shelters and out into the real economy. "It is difficult to imagine that had tax rates not been cut, the venture-capital and start-up culture of the (Silicon) Valley and elsewhere would have materialized as it did." These firms could afford to pay a decent salary as nearly all of it was not confiscated by the government as previously. The tax cuts also allowed capital accumulation, the rate of return for the highest earners went from 9 cents to the dollar to 30 cents. This is an increase of 233% and reflects the difference between a top rate of 91% and 70%.

The table below shows the income tax rates before and after the Kennedy cuts.

This was not a one-off case. In 1920-1921, the US faced the post-World War I Depression known as "The Depression of 1920-1921". Real GNP fell by 23.9% from 1920-1921, this is almost the same as the biggest annual drop in GNP during the Great Depression which was 23.4%. Commenting on the downturn, economists Richard K. Vedder and Lowell E. Gallway wrote, "While the magnitude of the 1920-22 downturn was severe (and indeed exceeded that for the Great Depression of the following decade for several quarters), its duration was not. By 1922 recovery was already underway, and in the following year unemployment was actually less than its normal long-run rate."

Under Presidents Harding and Coolidge, the top marginal tax rate was reduced from 73% to 25% and the bottom rate was reduced to 1%. Additionally, the minimum income subject to taxation was increased by roughly 50%. The result of this was what is commonly known as the "Roaring Twenties." During this period unemployment fell to 1.8%, the lowest in US history during peacetime.

Richard K. Vedder and Lowell E. Gallway wrote, "The Seven years from the autumn of 1922 to the autumn of 1929 were arguably the brightest in the economic history of the United States. Virtually all the measures of economic well-being suggested that the economy had reached new heights in terms of prosperity and achievement of improvements in human welfare. Real gross national product increased every year , consumer prices were stable…, real wages rose as a consequence of productivity advance, stock prices tripled….It was in the 20s that Americans bought their first car, their first radio, made their first long distance telephone call, took their first out-of-state vacation."

The table below shows the progression of the Harding/Coolidge tax cuts.

When President Reagan took office, the US was mired in stagflation, a combination of high inflation and weak economic growth. Similar to JFK and Coolidge/Harding before him, he also cut taxes reducing the top rate at first from 70% to 50% and eventually all the way to 28% in the 1986 tax reform. Additionally, 25 tax brackets were reduced to 14 brackets and eventually to 2 brackets in the 1986 tax reform. The Reagan recovery stated in the last quarter of 1982. In 1983, GDP grew by 4.5% and in the following years grew at 7.2%, 4.1%,3.5%, 3.4% and 4.1%. The average growth rate in these years was higher than the trend of post-war prosperity.

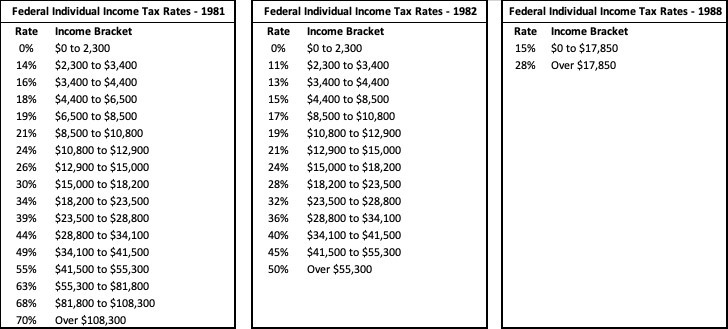

The tables below show the progression of the Reagan tax cuts.

Taxes affect the actions and incentives of those who they are levied upon. Ronald Reagan had personal experience with the effect of high taxes years before he became President, his description gives a practical demonstration of the destructive effect excessive taxation can have."At the peak of my career at Warner Bros., I was in the ninety-four percent tax bracket; that meant that after a certain point, I received only six cents of each dollar I earned, and the government got the rest. The IRS took such a big chunk of my earnings that after a while I began asking myself whether it was worth it to keep on taking work. Something was wrong with a system like that: When you have to give up such a large percentage of your income in taxes, incentive to work goes down. You don't say, "I've got to do more pictures," you say, "I'm not gonna work for six cents on the dollar." If I decided to do one less picture, that meant other people at the studio in lower tax brackets wouldn't work as much either; the effect filtered down, and there were fewer total jobs available. I remember one scene in the Knute Rockne picture that had only a farmer and a horse in it: Shooting it on location created work for seventy people. The same principle that affected my thinking applied to people in all tax brackets: The more government takes in taxes; the less incentive people have to work. What coal miner or assembly-line worker jumps at the offer of overtime when he knows Uncle Sam is going to take sixty percent or more of his extra pay?"

It is important that any proposed tax cut be marginal. A non-marginal or Keynesian tax cut is "one that increases exemptions or deductions, involves a rebate against taxes paid, or cuts lower rates in the progressive tax code but not the upper ones." This kind of tax has an "income effect", meaning that 'individuals get to keep more of the money they are already earning." The problem with this kind of tax cut is that since "further earnings remain unaffected", there is no incentive for individuals to work more, make more money or take part in additional economic activity. On the other hand, marginal tax cuts not only have an "income effect" but also a "substitution effect". People get to keep more of the money they've earned, but they also get to keep a higher proportion of money they will make in the future. This is the substitution effect where individuals "substitute economic for noneconomic activity, given that new economic activity pays more on account of the tax rate cut." People might choose to work extra hours, get off government benefits and take a wage paying job or possibly withdraw money out of a hedge investment in gold or oil in order to start a new business.

Contrast the effect of the Kennedy tax cuts with the effect of the non-marginal Bush tax cuts. They only reduced the top rate by 0.5% and "bloated the code with credits and exemptions." Growth was so sluggish that the Federal Reserve disastrously expanded money without take price increases in gold and primary commodities into account. "tremendous capital reallocation into the old inert dollar hedges came about." The prices of gold, oil and land skyrocketed, arguably a major factor in the housing bubble.

The Case for a Corporate Tax Rate Cut

"When a corporation loses a hundred cents of every dollar it loses and is permitted to keep only fifty-two cents of every dollar it gains, and when it cannot adequately offset its years of losses against its years of gains, its policies are affected." This has multiple economic effects, for example a corporation will decide not to expand its operations or will only expand those that have minimum risk, individuals are deterred from starting new enterprises. Old employers might decide to employ less people than they would have in the absence of high taxes and some may decide not to employ any new people at all. Additionally, it takes a longer time for improved machinery and better-equipped factories to come into existence than would be the case without penalising taxes.

In the 1960s, the common view among economists was that the corporate tax fell on owners of capital. In 1962, Arthur Harberger explained why the full burden of corporate taxes would fall on capital "in a standard economic framework". "In a simple closed economy, or in other words an economy where there is no intercountry investment and there is fixed capital and labour supply, the corporate tax has the effect of pushing capital out of the corporate sector into the non-corporate sector. Consequently, the after-tax rate of return to capital is lowered in both sectors. Harberger "showed that the return to capital was reduced by the amount of collected tax revenue and that wages remained constant."

However, this economic orthodoxy has been reversed in the decades following the 1960s as the global economy has become more and more interconnected. "Information costs have fallen dramatically, technology has integrated businesses around the world, international financial markets have flourished, and trade barriers such as tariffs have decreased." "Increasingly, corporations and investments can be moved to other countries, especially over time." If Harberger's closed economy assumption is replaced with an assumption closer to today's economy, a "modern open economy in which corporate capital can move to avoid higher taxes", the tax burden moves from the owners of capital to labour.

It is a common misperception that corporate tax rate cuts only benefit the wealthy. However, "a tax cut for businesses is a wage increase for workers." For example, in the United States, 54.8 million individuals are employed by corporations and these workers are the ones actually paying 75% of the corporate tax rate through reduced wages. In today's open economy, corporations and their investments can move to other countries. As corporate capital moves abroad to avoid higher taxes, the burden of the tax moves from the owners of capital to labour. When capital moves outside the country, the domestic capital-to-labour ration falls which slows productivity and lowers wages. Even though, the global capital-to-labour ratio is still the same, generally workers are not internationally mobile which means that "wages remain depressed in the country with the higher corporate tax rate and lower levels of investment." Since labour supply is limited by fixed factors such as population size, "an increase in capital investments allow wages to be bid up as labour becomes relatively scarce compared to the expanded capital stock." This explains why higher capital-to-labour ratios are better for workers. It has been estimated that "an 8 percent increase in capital per worker would increase wages by 13 percent to 20 percent."

Harberger himself revisited his work and reversed his 1962 thesis in both 1995 and 2008. He concluded that since the modern economy is open, it will be labour who "must end up bearing more than the full burden of taxation."

Kevin Hassert and Aparna Mathur conducted a study where they used aggregate manufacturing data for 72 different countries from 1981-2002. They found that an increase of a dollar in tax revenues was associated with a fall in wages of $3 to $4. This implies that "labour can bear upto 400 percent of the corporate tax." Another study by Li Liu and Rosanne Altshuler made use of individual US worker data, industry-level effective marginal tax rates and capital-to-labour concentration and found that on average labour bears 80% of the corporate tax and this figure can go all the way up to 119%. Other research that used wage bargaining models "to assess how profits are divided between labour and capital" found an incidence of 60% is born by labour.

References

Lawrence A. Kudlow and Brian Domitrovic, JFK and the Reagan Revolution: A Secret History of American Prosperity (New York City, New York: Portfolio, 2016).

Ronald Wilson Reagan, An American Life (New York City, New York: Threshold Editions, 1990).

Domitrovic, Brian. Econoclasts: the Rebels Who Sparked the Supply-Side Revolution and Restored American Prosperity. Wilmington, Delaware: Intercollegiate Studies Institute, 2009.

Henry Hazlitt, Economics in One Lesson: the Shortest & Surest Way to Understand Basic Economics (New York City, New York: Three Rivers Press, 1946).

https://files.taxfoundation.org/legacy/docs/fed_individual_rate_history_nominal.pdf

https://www.cato.org/publications/commentary/jumpstarting-economy

https://www.coolidgefoundation.org/blog/president-coolidges-economics-lesson/

https://www.cato.org/publications/commentary/jumpstarting-economy

https://www.heritage.org/taxes/report/the-high-price-american-workers-pay-corporate-taxes

https://www.heritage.org/taxes/commentary/america-competitive-again-thanks-lower-corporate-tax-rate

Contact us

246 Linen Hall, 162-168 Regent Street

London W1B 5TB

Director : Robert Oulds MA, FRSA

Founder Chairman : Lord Harris of High Cross