Does the EU’s Single Market Encourage FDI into the UK?

'Isolation' and inward investment

Michael Burrage

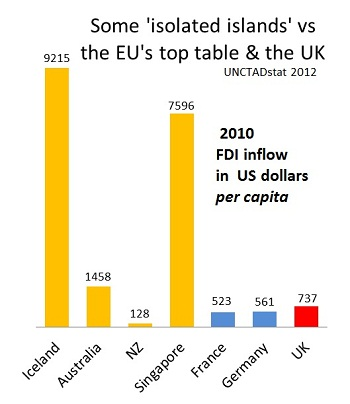

This paper examines the claim that the single market has helped investment, and specifically the foreign direct investment (FDI) into the UK, which has in recent years contributed somewhere between a fifth and a half of the total gross UK capital formation. Membership of the EU’s single market is commonly assumed to have been a key factor in encouraging foreign investors to choose to invest in the UK.

The main finding is that the annual flows of FDI into non-members of the EU in Europe, and selected non-members beyond, have not declined or suffered in any respect because they are not members of the EU. On the contrary, they have increased at a significantly faster rate than those of members of the EU, and this disparity is especially marked among the European non-members.

Overall the evidence suggests that the importance of the EU and the single market as a determinant of FDI have been exaggerated by its enthusiasts. The experience of eight independent countries over 21 years is compelling and convincing, and it allows us to reasonably and safely assess that there is no risk that FDI into the UK would be jeopardized, threatened or reduced if Britain were to put itself in the same ‘isolated’ position as the eight independent countries studied in this report.

The facts also suggest that, rather than a risk assessment of withdrawal from the EU, it would now be more appropriate and timely to conduct a risk assessment of remaining in the EU, and of the chances of the UK declining towards the EU norm.