The EU’s Credibility Crunch: Creator of economic downturn, Impediment to recovery

Damon Lambert

After the EU agreed its 'Economic Recovery Plan' José Manuel Barroso said “Europe has passed its credibility test”. Yet, in the paper The EU’s Credibility Crunch the Bruges Group finds that the European Union has been a major contributor to the economic malaise in Europe and is not a credible body to face the challenges of the downturn.

Nevertheless, the European Union is using the economic crisis to expand its power; particularly by using it as an excuse to push for the Lisbon Treaty to be ratified and even to re-start the debate in Britain on joining the euro.

Also in this paper, the Bruges Group sets out the policies that Britain must follow which including freeing-up trade, cutting taxes and government expenditure, and begin with leaving the shackles of EU control.

Click here to read the full analysis online>

Below is a summary of some of the reports key findings;

The EU’s Economic Recovery Plan

An expensive irrelevance

The Bruges Group’s analysis finds that the EU’s Economic Recovery Plan, agreed on Friday, 12th December, will cost Britain 1.5% of GDP which is £25 billion; a sum our debt laden economy simply cannot afford. That amount is equivalent to 6 pence off the basic rate of income tax for a year, or £417 for every man, woman and child in the UK.

• The EU’s plans for recovery are irrelevant to the present situation; the Recovery Plan is an excuse to fund the European Commission’s pet projects, for example; money for environmentally-friendly cars and factories, expanding internet access to very rural areas, all irrelevant to the financial crisis.

The EU’s myths rebutted

The myth of a lack of EU regulation

The EU claims that the economic crisis is due to a lack of EU financial regulation, yet, the EU is the author of most financial sector regulation. Any faults in that legislation primarily belong to the EU.

All the EU banks that are having difficulties met their core EU regulatory capital requirements in their 2007 financial statements.

There is already an 8,000 page regulatory rulebook and 2,600 regulators at the Financial Services Authority alone. Better quality, and more localised, regulation is needed instead.

There are even moves for increased regulation of financial sectors that are not responsible for the downturn.

There is already a glut of international bodies facilitating the co-operation of financial service regulation.

The myth of an American problem exported to the EU

The EU’s labelling of the economic crisis as a “US problem” is misleading. There is $2,520 billion of government support pledged to EU banks compared to $700 billion for US banks.

The ‘need’ for the bail-out in the EU has not been driven by losses incurred in the USA but from problems originating inside the European Union. It should be noted that the UK bank with the highest US exposure, HSBC, is regarded as the safest bank in the UK.

How the EU is damaging the economy

Excessive EU regulation

European economies would be better placed to deal with the downturn if EU membership did not weaken them.

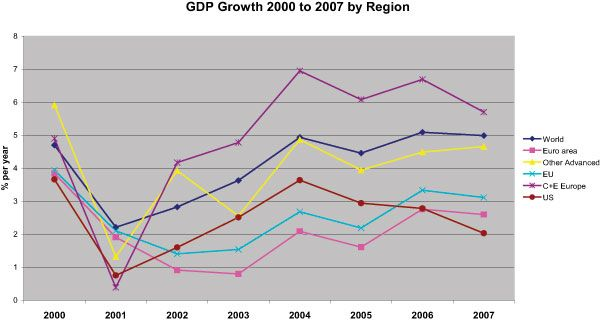

The EU has grown considerably slower than the other advanced economies which are not within the European Union. This contradicts the well-propagated myth that the UK could not survive outside the EU; statistics show non-G7 developed economies outside the EU grew by 1.42% more each year than EU economies; such faster growth would benefit the UK by at least £18 billion per year including £6.6 billion of additional tax revenues.

Restrictive trade policies

The inability of member states to negotiate their own trade agreements has prevented pro-free trade states, including the UK, from expanding their markets. Since 2000, Australia and the USA have eliminated tariffs and created pro-growth new free trade zones covering hundreds of millions of people, whilst the EU has stood still.

The EU and the property boom

Certain EU policies, notably on migration and the effective enforced ending of Dividend Tax Credits, are among the contributors to the damaging property bubbles arising in several member states.

The impact of the euro

Since 2000 the eurozone has been the slowest growing region of the major developed economies; the world economy has grown at a rate 98% faster than the EU area.

The euro is a “one-size-fits-no-one” policy. It is unsuitable for high growth economies; e.g. financially prudent Ireland is now in recession due to the euro’s uncompetitive exchange rate and high interest rate policy. However, members of the euro having made their currencies extinct have no short-term prospect of a White Wednesday rescue.

The European Central Bank has committed major mistakes in responding to the economic crisis. As recently as July 2008 it increased interest rates rather than cutting them to avoid the recession.

Robert Oulds, Bruges Group Director, says,

“The European Union’s approach to the recession is one of top-down instruction by the elites to businesses and individuals of Europe. However, there is no better time to note that the eurozone’s economic performance is the worst in the developed world and wake-up to the benefits of being a free-trading economy, free of the EU’s costs and shackles

“There is a need to defend businesses and the taxpayer from yet more regulation and wasteful EU spending.”

Damon Lambert, author of the report, says,

"The EU, with its damagingly high interest rates, its regulations that weakens banks and a trade policy that isolates Europe from the benefits of globalisation, is a major cause of the recession. Yet, its Economic Recovery Plan is merely a wishlist for its pet projects that will cost each single UK resident £417. At a time when economic management skills are key, the EU has a major credibility crunch.”

About the Author

Damon Lambert is the UK Corporate Tax Director of a major European Bank. Previously, he worked for 11 years in KPMG’s financial sector practice where he specialised in advising on mergers and acquisitions, primarily for financial sector multinationals. The advice he provided to clients included amongst other issues the impact of the EU and the ECJ on UK tax law. Damon is a qualified Chartered Accountant. He regularly writes on European tax matters and was a member of the working party on the Tax Reform Commission instigated by George Osborne, co-authoring the chapters on business taxation and tax reforms in other jurisdictions.