Bruges Group Blog

Brexit in a post-Coronavirus World

The challenges and the opportunities

With the speakers;

- Rt. Hon. Sir John Redwood MP

Professor Tim Congdon CBE:

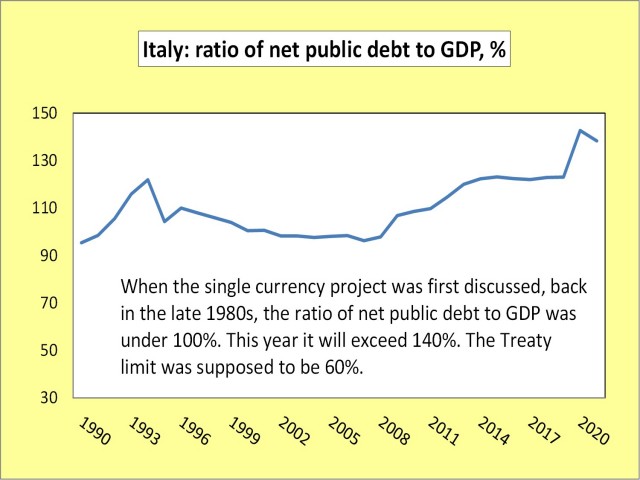

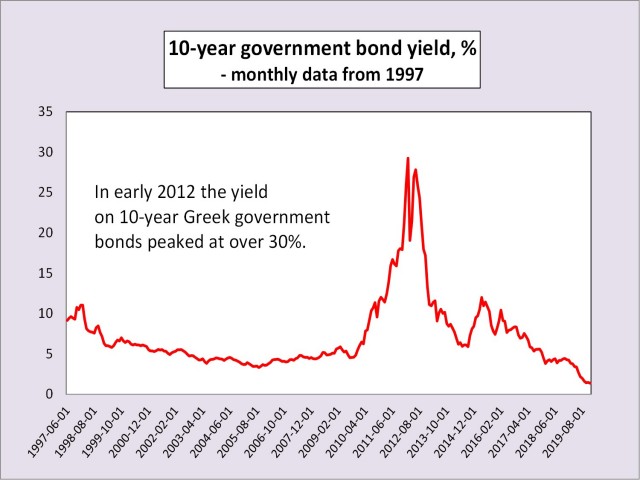

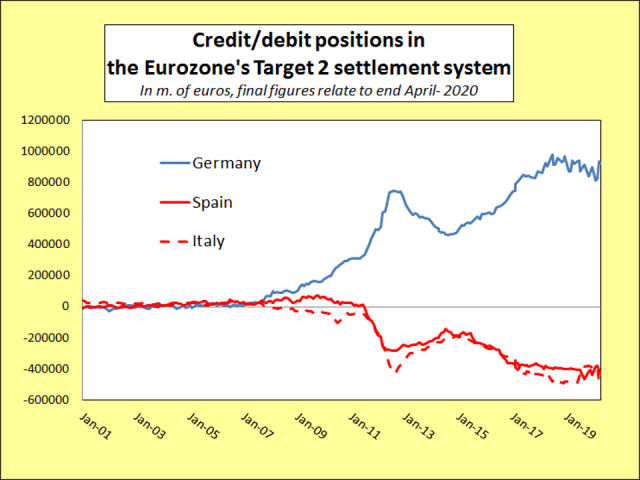

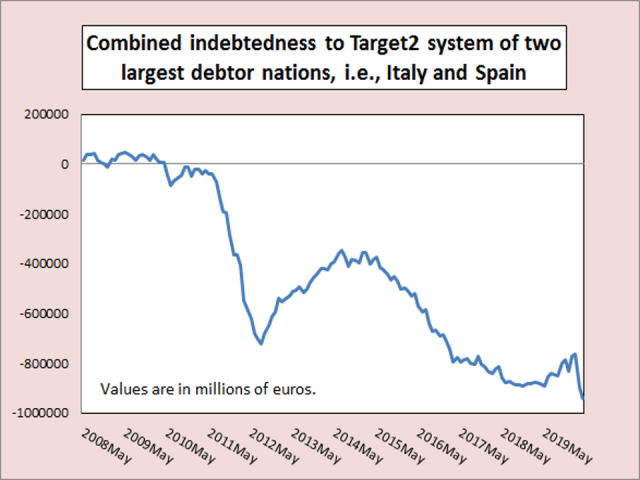

Are Eurozone Trends in Public Debt and Financial Imbalance Unsustainable?

Quotations from the April 2020 ECB Economic Bulletin

1. "…the general government budget deficit in the euro area is projected to increase significantly, to 8.5% of GDP in 2020, compared with 0.6% in 2019. Although the deficit ratio is expected to shrink to 4.9% in 2021, it is still expected to stand at 3.8% of GDP in 2022, as the drag will be longer to fully dissipate." (p. 42)

2. "As a result of the COVID-19 pandemic, the euro area aggregate public debt-to-GDP ratio is projected to surge to 101.3% of GDP in 2020, before declining very gradually. The increase in 2020, of 17.2 percentage points compared with 2019…" (p. 44)

Professor Patrick Minford CBE:

Brexit, Forecasting Coronanomics, the Public Finances and post-Brexit Fiscal Policy

Brexit: The Key Points

• Brexit brings big gains to UK from free trade, implementing our own regulation, control immigration, budget: total 7% of GDP in long run

• Remainers argue losses from EU-UK barriers: but this is wrong - FTAs with ROW bring world prices/competition to UK. EU has no effect on this. Remainers are using the wrong model which are rejected by UK trade facts.

• If we leave on WTO rules, tariffs cost the EU, not UK; furthermore, non-tariff barriers are illegal.

• No deal bad for the EU and the UK are better off with no deal than a delay.

• Delay embroils the UK in a Eurozone COVID bailout crisis.

• So a Canada+ deal is likely.

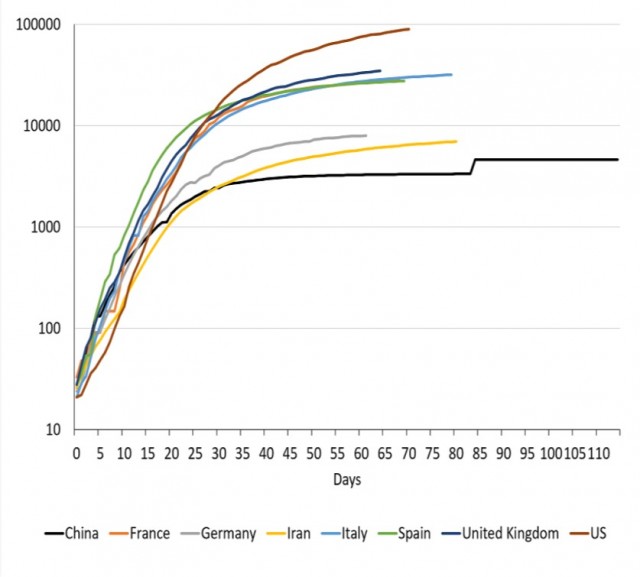

The Coronavirus Facts

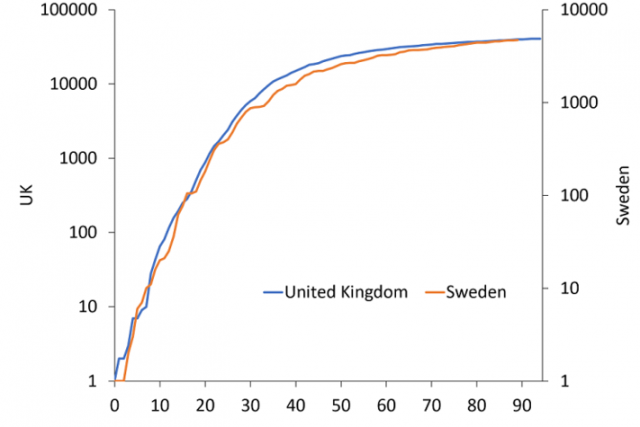

The logistic curve applies all epidemics for a start, this is an initial arrival (foothold/rapid spread) with low infection rate ie. saturation and then slowdown of the spread rate falls with proportion infected. As for lockdown, it's no better than social guidance of Sweden, apart from the fact that it worsens the resulting recession.

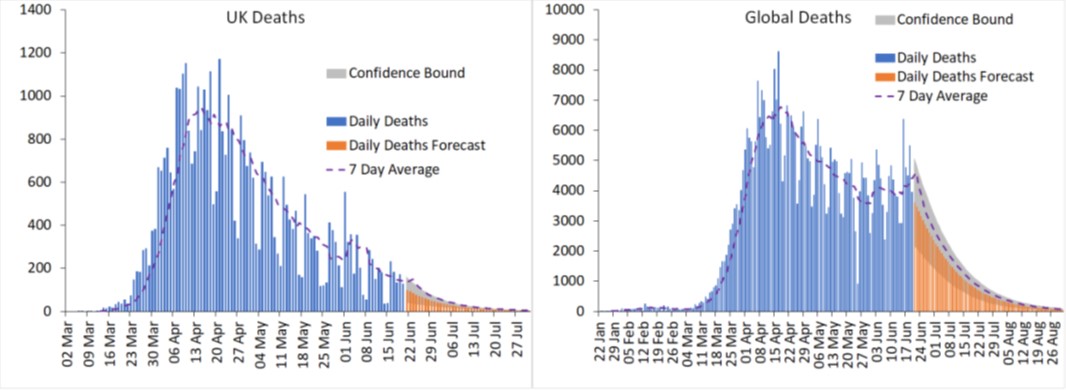

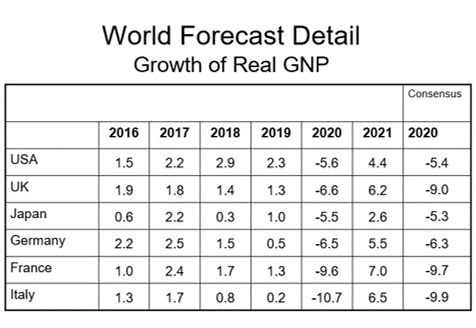

What Sort of Recovery?

The difference of this recession is that it is caused by the government, whereas most recessions caused by demand/supply shocks beyond government control. Therefore, what a government caused, it can undo directly. As seen, the virus will retreat in UK and other developed countries by mid to late July. Developing countries could not afford lockdown so subsequently the virus will retreat there later, and then those economies will recover in line with West.

UK PMIs in May (April): manufacturing 40.7(32.6); services 29.0 (13.4); construction 28.9 (8.2). (June): Manufacturing 50.1; Services 47.0. April (lockdown month) : UK retail sales at 18.1% April; before a +12% in May. Compared the US retail sales: recover in May: +18% on April, after -15% April on March.

The Public Finances and the Virus

The capacity of public debt is backed by money sovereignty to finance the crisis and rests on low current interest cost of borrowing: 0.4% approximately on very long maturities. This is due to an unusual situation of zero lower bound and a world savings glut; therefore, in principle the government can issue perpetuities paying just 0.4% coupon only.

Current borrowing is around £300 billion during the course of the pandemic and is offset by bank purchases of £300 billion under a quantitative easing programme. The government has lent to itself so far in essence. The Bank of England should offload debt steadily into the market soon to make use of a low interest rate environment and therefore aim to sell debt at longest maturities.

Once recovery occurs, money supply growth will threaten inflation which will mean we need to tighten the money supply, raise interest rates and end zero lower bound; this will mean monetary policy is empowered again. The aim should be to float off debt before this occurs, to capitalise on low rates while the low rate market persists, as is likely until recovery takes clear hold.

Fiscal Fund and post-Brexit Package

The Treasury should aspire to a cocktail of pro-entrepreneur tax cuts worth £100 billion, these could be:

- Cut corporation tax by 10% to a rate of 9% : £32 billion

- Abolish the very top additional 5% rate (making the top band 40%): £1 billion

- Cut the current top rate of income tax to 30% (from 40%): £15 billion.

- Cut the standard rate of income tax by 5% (making the standard base rate of income tax 15%): £28 billion.

- This would give a total of £76 billion, representing a weighted average tax cut across all income of about 15%, leaving £24 billion extra (about 1% of GDP) for spending on public services and infrastructure.

- Effect to raise growth by 1% per annum accounted to the Liverpool Model.

- Consistent long run fiscal rules, consequently ending zero interest rates.

Contact us

246 Linen Hall, 162-168 Regent Street

London W1B 5TB

Director : Robert Oulds MA, FRSA

Founder Chairman : Lord Harris of High Cross