Bruges Group Blog

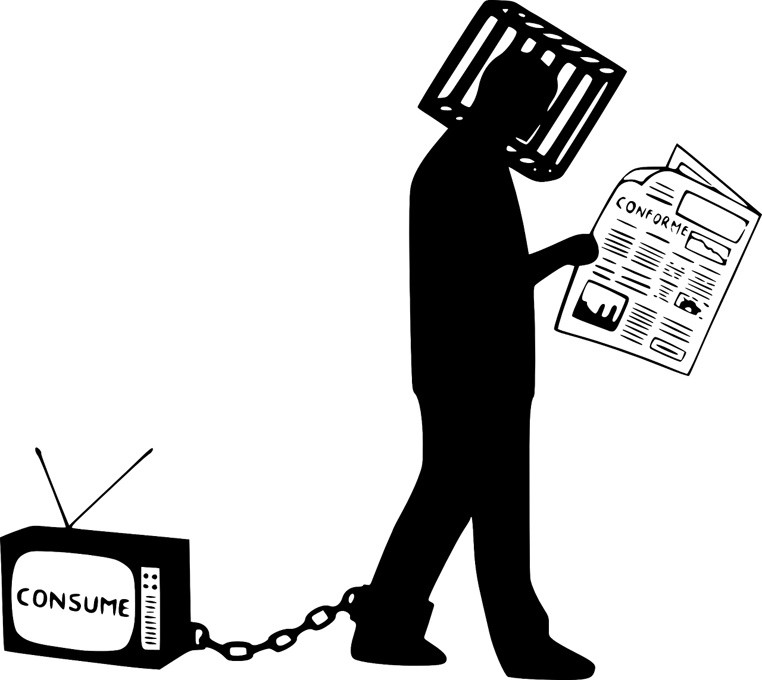

Those of my generation may very well remember the hit song 'Three steps to Heaven' by Eddie Cochran, released in 1960. Now however I believe that we face three steps to Hell which, if they are taken by our society, will see the total destruction of the right to privacy, and make it impossible for anyone to live a quiet, anonymous life free of super...

It was, from what I gather, George Bernard Shaw who made the famous quote that "Youth was wasted on the young". Now I am in the later years of my life and look back I can see how I wasted my youth, although I must admit to having a good time spending my earnings on booze and sports cars. It was not until I was married and into my thirties, when wor...

he EU's shadow borrowing has continued to increase, and rapidly. That is the message given by this high-level update by Bob Lyddon, international banking expert and author of 'The shadow liabilities of EU Member States, and the threat they pose to global financial stability', which was published by The Bruges Group in 2023 and used year-end 2...

Mr. Speaker, it is an honour and a privilege for me to have this opportunity to present to the House the government's budget for the coming year. As the House will already know, our economy and government finances are in a desperate and sorry state. Over the past nearly 25 years we have suffered a series of setbacks that have enveloped us in a perf...

The United Arab Emirates is causing increasing concern in democratic capitals. Russia's invasion of Ukraine prompted western nations to impose sanctions on them. The purpose was to constrain Russia's ability to wage an illegal war through economic sanctions. Although a bullies appetite is never sated this has not deterred the UAE and to a lesser ex...

Britain's political scene is sporadic, but one constant stayed through it all: skyrocketing national debt poor judgment in allocating public spending. Since 1988, national debt has gotten out of control, and now sits beyond GDP. Parliament's economic judgment have faltered post-Thatcherism, with successive prime ministers failing to replicat...

Multiple credit cards and a carefree attitude to paying-off bills was at one time the preserve of the more feckless section of society. These days it seems to be a universal ill of local finances and it is a trend that central government has fostered. As local authorities teeter on the brink of insolvency – indeed by any 'normal' accounting assessm...

By Christine McNulty Plato believed there exists an inescapable duality, a conflict between mind and body. He viewed human emotion as an enemy and saw reason as a "charioteer commanding horses: the unruly passions" - a view that has echoed down through the centuries.But the history of human achievement is a powerful testimony to the fact...

Reform or Revolution? This is the question. One way or another there will be no more "status quo" on our current course because: if Labour wins, we will have socialism; if things do not change, history shows there will be violence (a revolution). The parallels between the present and the French Revolution (as well as the fall of Rome) are self-evid...

I have been following a select group of (mostly American) financial commentators since 2007, before the Global Financial Crisis. Their tone is even more sombre now. Charles Hugh Smith posted 'I Have a Very Bad Feeling About This' a few days ago, following it with 'No, Central Banks Won't Save Us This Time.' He has been warning for years that we sho...

Last Saturday we went to the theatre in Windsor. The car park no longer has a machine that takes cash. It does have two parking aps. The first was out of order, or at least it could not be downloaded. The second was one my wife has. Her credit card is registered with them, but she could not pay. She phoned them. A human sorted the problem, confirme...

We are pleased to publish this analysis by Sebastian James based on his blog at The Blue Anchor. PART ONE After the vote to leave The Guardian started a regular tracker to chart its impact on the economy. But as the Remainer predictions turned to dust and the good news kept piling up the Guardian quietly dropped this feature. So I'm reviving ...

The German Federal Audit Office ('Bundesrechnungshof') has warned that the Bundesbank may need a bailout due to losses on the EUR650 billion of bonds it bought as part of the Eurozone's equivalent of Quantitative Easing. The Daily Telegraph reported on this on 26 June. Of course the risk is not for the entire EUR650 billion but for the fraction by ...

The general public has little idea of how much debt hangs over our heads. Today, Laura Perrins warns us that government borrowing is now equivalent to 99.2% of GDP (i.e. a whole year's worth of national economic activity); but that is only the tip of the iceberg, because it is only looking at public sector borrowing. Unlike the UK, where valuable f...

The totality of the public sector liabilities of EU and Eurozone member states is clouded in obscurity. The key measure tracked by Eurostat - 'General government gross debt' – is circumvented to such an extent that, based on year-end 2021 figures, debts of around €6.4 trillion failed to be registered, and contingent liabilities of around €3.8 trill...

John Redwood's Lecture, All Souls College, Oxford Rt Hon Sir John Redwood will be giving a lecture on the great western inflation of the last two years. He will examine the role of the Central banks, explain how they could have avoided the general price rises, and ask how the Bank of Japan, the Swiss Central Bank and the People's Bank of Chin...

The EU member states contain numerous public sector entities with borrowing powers, and whose debts fall outside the definition of member state debt as reported by Eurostat. The responsibility for the debts tracks back, one way or another, to the member state but the amounts involved are opaque. All that can be said with complete certainty is that ...

The EU and its member states position themselves as a cornerstone of the rules-based international order, but they break its financial rules in both letter and spirit by failing to fully report their financial liabilities. The key measure tracked by Eurostat - 'General government gross debt' – is circumvented to such an extent that, based on year-e...

EU and Eurozone member states fail to fully report their financial liabilities. The key measure tracked by Eurostat - 'General government gross debt' – is circumvented to such an extent that, based on year-end 2021 figures, debts of around €6.4 trillion failed to be registered, and contingent liabilities of around €3.8 trillion. This discrepa...

Whatever the choreography we have a clog dance not a ballet. Sunak's 'deal' is yet another fudge. Involving the King in politics and the manipulation, copied from the EU, demonstrate a cynical disregard for probity. The Northern Ireland Protocol is a travesty. No Independent nation can agree to be ruled by a political court (The ECJ) whose sole rem...

The Bruges Group is pleased to republish this article by Barnabas Reynolds Brussels' rules are prescriptive and controlling, and are holding back British growth The Prime Minister must restore Britain's sovereignty over our laws The Government is seeking the power to remove some of the vast swathes of EU-inherited law by the end of 2023 in it...

The Prime Minister advocates that the teaching of Maths should be a priority, although one suspects that he really means numeracy, as the ability to add up a few figures is more useful for the average person that knowing all about the calculus of the hyperbola. However the level of debate concerning economic matters in this country makes clear that...

For over a century the UK has struggled with political realism and to an extent, its identity. In 1918 the Labour Parties pamphlet 'Labour and the New Social Order' set out an essentially communist agenda. Beatrice and Sidney Webb's 1920 book ' Constitution For The Socialist Commonwealth Of Great Britain' fleshed it out. Many were taken in by talk ...

The short-lived Truss government came to power with a mandate to change Britain. She fought her campaign clearly stating her policy. She was lawfully elected according to the rules. Her policy was designed to produce growth. Cutting taxes was a part of the program. The respected US Tax Foundation in its 2020 report on UK tax wrote: "All things bein...

A competent Conservative Government would have rectified the anomaly of taxable income between £100,000 and £125,140 being subject to an effective tax rate of 60%. It is clearly anomalous for the effective tax rate to rise from 40% to 60% on income in this band and then fall to 40% on income between £125,141 and £150,000 before rising to 45% on inc...

The UK faces problems, problems that to a great degree are the fault of the political and financial establishment. There is no point in blaming every ill on Covid and Ukraine indeed it is only to the latter crisis that the establishment response has been sure footed. Otherwise, the failures are legion. Brexit has not been fully implemente...

By Barnabas Reynolds. The Brexit Freedoms Bill aims to end the special legal status of EU law. It will also simplify the removal of retained EU law. Here Barnabas Reynolds explains the advantages for the City – and the economy. The UK has recently been confronted with a series of adverse economic shocks – from Covid and the war in Ukraine, to the c...

Some people who start a business dream of it becoming an enterprise that is passed down through generations. While this is true for some companies and families, it can also be a fraught ambition. Families can be dysfunctional, and when that dysfunction is transferred to the workplace, it can be catastrophic for the business. Furthermore, there is n...

Outputs from Spring Statement In advance of the promised reveal of the government's energy plan this week, let's start with the positives from Rishi Sunak's Spring Statement. 5 whole years of VAT free purchases on solar panels, ground and air source heat pumps. Not in Northern Ireland of course but they seem to matter less than ever to the Conserva...

A few weeks ago, I saw a sign stuck to the plastic screen dividing me from a barista. To précis, electronic payment preferred, cash as a last resort. When I politely enquired as to why, I was told, albeit politely, that whilst it was not "due to COVID" (no sensible business is still using that schtick are they?) despite the transaction cost, it was...

Crypto regulations would have been identical for both the EU and the UK. However, the Brexit game brings chaos, and hence the crypto regulations, including the famous Bitcoin and Ripple, are independently defined, yet few sections overlap. This guide will bring some light on the cryptocurrencies regulations in the United Kingdom and European Union....

US states courted for deals on financial services after US tariffs on steel and aluminium lifted. A look at the improving UK trade with US and Canada While all eyes have been on the possibility of a large bilateral deal with the US, the two governments have been reaching across the pond to strike small deals that amount to great improvements ...

Download PDF File Here Mr Sunak's Spring Statement was far less impressive than his rhetoric has made it appear. Once again a senior member of this administration reaches a Gold Standard in rhetoric, but at best a Bronze one in achievement. The claim does not stand up to examination that these were the largest reductions in personal taxation for th...

The European Commission is the executive branch within the broader European Union or EU. It apparently intends to introduce the continent's own digital euro bill sometime during 2023. This would coincide with experimentation done by the European Central Bank with a retail version of central bank digital currency across the union. Movement Among Mix...

The current cost of living crisis and stagnating growth highlight the importance of a re-examination of our approach to tax, trade and business, writes John Longworth. During the pandemic, conspiracy theorists loved to talk about the "great reset" that would be orchestrated by the Davos-loving global elites. If the events of the past two weeks is a...

By Professor Patrick Minford, CBE Patrick is the Chairman, Economists for Free Trade. He is Professor of Economics at Cardiff Business School, part of the University of Wales. Patrick is the author of The Cost of Europe, and Should Britain Leave the EU?: An Economic Analysis of a Troubled Relationship. Professor Minford is also a member of the Brug...

The USA is bust. Not officially of course and as Francis Underwood (I know, it was Urquhart first but humour me) would say, "You could say that; I couldn't possibly comment". With Federal Government debt in excess of $30Trillion and debt servicing alone of almost $600Bn per annum, the country is ill prepared in every conceivable way for a protracte...

Big Tech, so long the natural bedfellow of Planet Woke may just be starting to see the impact of its commitment "to the cause" through a, let's be generous, "correction" in their stock market capitalisation (numbers of shares in issue x cost per share). The mighty Apple, the nerve centre of Silicon Valley wokeism became the first company in history...

The case for a new Bretton Woods, Kevin Gallagher and Richard Kozul-Wright, paperback, 163 pages, ISBN 978-1-5095-4654-1, Polity Press, 2022, £9.99. Kevin Gallagher is Professor of Global Developmental Policy and Director of the Global Developmental Policy Center at Boston University. Richard Kozul-Wright is Director of the Division on Global...

The argument put forward by Brexit critics in the past, and now, is a combination of such: 1) The world moves in large, multilateral blocs – hence being part of the EU, the closest possible multilateral bloc, means the UK can stay an active part of the world economy. In an era where big collective action must be taken, from bulk buying PPE in a pan...

At Conservative Party Conference this year, we are delighted to be hosting the 'Liberty Zone' on Monday 4th October 2021 at the Science and Industry Museum, Liverpool Road, Manchester, M3 4PF. We are holding our annual Party Conference event this year alongside Time 4 Recovery, a group set up to pressure the government with oppositi...

Economic victory in a free trade world will always go to the strongest economy – and the disparity is growing. Against this a new concept has emerged: technology sovereignty. This recognises that IT infrastructure lies at the heart of a modern society. And it's about far more than access to broadband. Networked computers are not only essentia...

If you don't know what crypto or digital currency is and you've never heard the word Bitcoin being bandied about in a cocktail conversation then welcome to the new millennium, we are happy to have you! Yes, cryptocurrency has taken hold and the world economy has certainly taken notice. Consider that the leading crypto, Bitcoin, was born only a doze...

How the Commonwealth of Nations Can Become the Most Innovative Bloc in the World By Alexander Flint Mitchell MSc Dissertation for Business Innovation with EntrepreneurshipBirkbeck, University of London2020 ABSTRACT Much has been written on the three topics of the literature review of this thesis: innovation, the Commonwealth of Nations' ...

Panelists: Barry Legg (Chair), Lord Dodds of Duncairn, Sir Bernard Jenkin MP, James Webber Barry Legg, Chairman of the Bruges Group: Our next speaker is Bernard Jenkin. Bernard is Chairman of the House of Commons Liaison Committee, on which all select committee chairmen sit. Previously, he was Chairman of the Public Administration Select Committee,...

A major City group has just published a report calling for an immediate development of an e-pound Britain could create a Western alternative to a Chinese digital/e-currency It is not generally appreciated that over 98% of UK transactional banking (by value) takes place in what is known as 'the wholesale market'. Less than 2% takes place in the reta...

In recent days, the internet has been abuzz with the news of Joe Biden's proposed hike of federal capital gains tax to 43.4% for the highest earners. However, unsubstantiated rumours swirl of another, far more significant reform to American taxation: an 80% tax on cryptocurrency transactions. If true, it must be conceded that such a reform ha...

As a business owner, you are going to invest in numerous resources and tools to help your business grow. Some of those assets will be more tangible, like vehicles and computers, while others are a little more conceptual, like employees, and training strategies. Having a tracking system in place will help you to ensure that you're leveraging your as...

The online gambling industry is in a tricky situation across the world. Each one of the United States is coming up with its own set of regulations, the EU never had a centralised regulatory institution across the continent, and Asia doesn't look at gambling with a good eye either. Currently, online gambling operators settle in the Isle of Man or th...

This new study, issued through The Bruges Group, dissects a main response of the European Central Bank to the pandemic: another programme of bond buying, taking up hundreds of billions of euros of Eurozone member state government bonds into the ECB's Pandemic Emergency Purchase Programme, the "PEPP". The PEPP bought the majority of new debt issued ...

John Longworth was the Director General of the British Chambers of Commerce; he was also an MEP and co-Chairman of Leave Means Leave. A great problem with many politicians and most civil servants is that they don't understand business. The reverse is probably also true. The enterprise economy is alien to the political class and they tend ...

As the Chancellor prepares to deliver his Budget, we want to make clear a few brief advisories to Mr Sunak on what this historical Budget should contain. First of all, there has been plenty of speculation from countless newspapers and TV reports that the Chancellor is plotting tax increases, namely corporation tax and potentially freezing tax bands...

Bingo originated in Italy, and as it touched the UK's borders, Brits fell in love with it instantly. The love affair resulted in the springing up of bingo halls and charity games all over the UK in no time. As a traditional game dating back to the early 16th century, it later became typecast by youngsters as a game that older people play. Towards t...

Free of the EU’s Stifling Legal System, British Financial Services will go from Strength to Strength

By Barney Reynolds Like it, or loathe it, Brexit is an opportunity for Britain to reassert herself as a sovereign nation. For those of us who are optimistic about our post-EU future, we have only to point to the recent fiasco around the EU vaccination roll out as one example of how "taking back control" has already been beneficial. But t...

Barney Reynolds: Treasury Select Committee on the UK's Economic and Trading Relationship with the EU

On Monday 11th January The Treasury Select Committee discussed the UK's future economic and trading relationship with the European Union; Bruges Group speaker and friend, Barney Reynolds was invited to give evidence as a witness. Present at the meeting were Select Committee Chairman, Mel Stride MP (Conservative), Rushanara Ali MP (Labour), Steve Ba...

The Bruges Group Statement on Britain's EU Exit https://www.brugesgroup.com/blog/statement-on-britain-s-eu-exit ERG Star Chamber Legal Analysis The full text of the Star Chamber's analysis of the trade deal https://lawyersforbritain.org/wp-content/uploads/2020/12/ERG-Legal-Advisory-Committee-Opinion-on-EU-UK-Trade-and-Cooperation-Agreeme...

By Shanker Singham As the Agriculture Bill makes its way through Parliament, the UK faces a critical choice in its international trade policy. It is widely understood in trade circles that agriculture is the gate through which all trade policy flows. Long the bugbear of world trade, agricultural sectors all over the world have rigidly op...

Samuel Johnson famously said, 'when a man is tired of London, he is tired of life'. However, unlike S.Johnson, it seems that B.Johnson has succumbed to this, in light of the lack of news surrounding the future of our greatest financial asset, the City of London. Whilst the recent focus has been perpetually on State Aid and fishing rights, the City ...

Link to initial article By Julian Jessop Brexit talks resumed this week with growing hopes that a trade deal can be done in time for the October EU summit. This follows speculation that the UK has softened its position after Boris Johnson was 'shocked by a London School of Economics report suggesting that no deal would cost Britain up to three time...

Marathon talks have concluded between EU leaders as they battled over the details of its multibillion-euro pandemic recovery fund. With France and Germany head-to-head against the frugal four of Austria, Denmark, the Netherlands and Sweden over grants, veto rights and funding criteria, you could be mistaken for seeing the talks as the break-up of t...

Having experienced the entire process of leaving the EU since the Maastricht rebellion, through to the passing of the sovereignty clause, Section 38 of the Withdrawal Agreement Act 2020, including the result of the referendum itself, I am thoroughly aware that there must be no ECJ jurisdiction after 31 December 2020. The Governm...

The challenges and the opportunities With the speakers; - Rt. Hon. Sir John Redwood MP- Tim Congdon CBE- Professor Patrick Minford CBE- Dr. Gerard Lyons Professor Tim Congdon CBE:Are Eurozone Trends in Public Debt and Financial Imbalance Unsustainable? Quotations from the April 2020 ECB Economic Bulletin 1. "…th...

There's nothing very surprising when the EU spends money in individual member States to enhance its standing, and to influence people in those States to work in what the EU sees as its interests. That's known as old-fashioned pork-barrelling. But when the EU argues that the bankrolling of political organisations within a State by those outside it i...

Roland Vaubel Professor emeritus of Economics Universitaet Mannheim Germany Mr. Barnier seems to misunderstand the argument for maintaining a level playing field. The laws of a country, above all, ought to reflect the preferences of its people. It follows that the laws ought to differ between countries if, and to the extent that, the preferences of...

Margaret Thatcher's Bruges Speech to the College of Europe in September 1988 - YouTube https://www.youtube.com/watch?v=rqv8HF84EOs&t=1s The Bruges Group was set up in 1989 in honour of one speech, a now landmark address made by our then Prime Minister Margaret Thatcher to the College of Europe on 20th September 1988 on the 'Future of Europe'. L...

During this pandemic, I felt it would be the perfect opportunity to take a closer look to the careers of some political giants who don't always get the recognition or remembrance they deserve. One of my greatest interests is political history and every Friday I will publish an article outlining the career and some interesting facts about some polit...

Almost four years after we voted to leave the European Union (EU), Boris Johnson delivered on his promise to 'GET BREXIT DONE'. Little did we know at the time (on 31st January 2020) that the year was going to bring its own woes, which are now threatening to bring down the European dream of unity, solidarity, and borderless territory. In addition to...

Originally published in The Critic by David Scullion https://thecritic.co.uk/the-government-split-over-free-trade/ The Government is committed to signing Free Trade deals. The Conservative Party's 2019 manifesto said as much, and added: "Our trade deals will not only be free but fair". The UK has just started trade talks with the United ...

During these awful and bleak times, I felt it would be the perfect opportunity to take a closer look to the careers of some political giants who don't get the recognition or remembrance they deserve. One of my greatest interests is political history and every Friday I shall publish an article outlining the career and some interesting facts about so...

Institute of International Monetary Research Analysis Professor Tim Congdon CBE is a member of The Bruges Group Academic Advisory Council A lot of interest has been drawn from my recent emails to my fellow macroeconomists and monetary analysts where I pointed out that bank deposits at US commercial banks soared in the fortnight to 2...

During these awful and bleak times, I felt it would be the perfect opportunity to take a closer look to the careers of some political giants who don't get the recognition or remembrance they deserve. One of my greatest interests is political history and every Friday I shall publish an article outlining the career and some interesting facts about so...

First of all, may I say congratulations to Boris Johnson and Carrie Symonds who announced the birth of a healthy baby boy this morning, just after 10 am. It emerged last week that Britain would neither apply for, nor accept an extension, if offered, to the Brexit transition period from the EU. In his briefings, Chancellor Rishi Sunak set the ...

The internet is full of conspiracy theories about the pandemic and blame aimed at shadowy elites, bankers, secret societies, national leaders and so on, all based on the political prejudices of those formulating or sharing the theories as if fact. These are a not very amusing distraction from lockdown, pictures of kittens, today's lunch, or even po...

During these awful and bleak times, I felt it would be the perfect opportunity to take a closer look to the careers of some political giants who don't get the recognition or remembrance they deserve. One of my greatest interests is political history and every Friday I shall publish an article outlining the career and some interesting facts about so...

Margaret Thatcher's Bruges Speech, 1988 on The Bruges Group YouTube channel https://www.youtube.com/watch?v=rqv8HF84EOs Today marks the death of our greatest peacetime leader, Margaret Thatcher, a woman who defined British politics for more than a generation. Elected as the first female leader of any major political party in the UK in 1975, su...

This is a letter to an old friend from my undergraduate days, who went on to be a distinguished economist, describing the EU situation today. I am publishing this letter today, nine years after I first wrote it, just after receiving the news of the anger in Southern Eurozone countries against Northern Eurozone countries, when the latter showed unwi...

Last Wednesday, the Chancellor of the Exchequer, Rishi Sunak, celebrated 28 days in Number 11, following Sajid Javid's resignation, by presenting his budget to the House. This budget delivered by the Richmond MP is arguably the most favourable budget since the days of Nigel Lawson standing at the dispatch box outlining his financial forecasts and s...

If I had to attribute my entry onto the political stage to any individuals, it would be Mark Carney, George Osborne and Theresa May. Not because I was inspired by any of them but as a result, in the case Mrs. May, of her total ineptitude over Brexit and, in the case of the first two, the inordinate amount of nonsense they spouted in the run-up to a...

I would like to share with you the speech and presentation I made at The Bruges Group annual conference in London on the 7th March. Whilst the UK officially left the EU on 31 January, it remains in its Single Market [paying some £1 billion (net) a month], its Customs Union and subject to the supremacy of the Court of Justice of the EU (CJ...

Following the speeches of Mark Francois MP and Andrea Jenkyns MP, we are delighted to publish Professor Tim Congdon CBE's presentation to the Bruges Group annual conference on March 7th 2020. The Demographic Fate of Nations Women need to have 2.1 children on average in order to replace the current generation. Suppose that they have less than ...

Most loans that you'll use or find nowadays are what are known as installment loans. These loans are loans that you pay back in installments, hence the name. They typically have interest associated with them, and you can work to pay them back based on a pay schedule. Nowadays, you can get installment loans on the web without a lot of problems. But,...

Brexit is finally underway. By January 2021, the UK will be in a new position to help redefine itself in the world of global trading. Hopefully, it's going to put the country in a far more flexible economic environment. Free from the shackles of EU trading coffers, exciting times lie ahead, not only for businesses and their owners but for everyday ...

A secured loan can come in a number of different forms, all of which have different loan terms as well as differing APRs. Therefore, it is important that you conduct your research and compare prices at differing points as this will help you to save money in the long term. It is also important to read the fine print during this time, as a low APR do...

Authors: Ethan Thoburn, and Charles Wynne There are plenty of people talking about no deal Brexit at the moment and with Boris Johnson looking ever more likely to deliver that, we at The Bruges Group thought we would put together sort of a fact sheet on No Deal and how it won't leave us on a so called cliff edge as lots of the media like...

The following article and above PDF are speeches by Richard Tice MEP for the Brexit Party and also property businessman; Swedish-British billionaire businessman Johan Eliasch who is CEO of sportswear giant Head; Sir John Nott the former Secretary of State for Trade and Industry then Defence under Margaret Thatcher; Peter Lilley the former Sec...

Switzerland and the European Union have begun open financial war with each other as the EU tries to force the country to sign the proposed Framework Agreement covering all aspects of the country's relations with the EU. The EU has been forced into a hardball approach to Switzerland because with Brexit still unresolved it cannot afford to be weak. I...

Artificial Intelligence is certainly an area of focus post Brexit, the sector of AI was worth around $1.2 trillion as of around 2018 with predictions from Zdnet.com estimating the growth of the AI business values to around $3.9 trillion by 2022, that's a huge amount for any sector; this roughly equates to a forecasted prediction of just over £3 tri...

The EU is not a market, it is a political project of becoming a single European state, the United States of Europe, as the powers-that-be in the EU have always wanted it to become. The three founding fathers of European union all called for a single European state. Konrad Adenauer said, "My dream is that one day we might be able to applaud a United...

Author:CATHERINE BLAIKLOCK Would you like to lend to the German government and get paid a grand total of 0.43% a year for 10 years? Or how about lending to the French government and getting 0.73% or to the Spanish government at 1.35%? An annual yield of 1.35% a year, lending to Spain and you are invested for 10 years. Doesn't sound very good, does ...

Bruges Group director Robert Oulds assured the possibility of a Brexit trade agreement in an interview with Jeremy Naylor on IG.com. It was one of the many issues discussed during last Friday's broadcast. Topics ranged from the cost of other trade agreements, need for deregulation, lower taxes, and passporting rights. The term "hard Br...

The crown of UK is its financial services sector: buying and selling across the EU and the world. Now, fresh fears about the backbone industry of London are on the rise. EU's chief Brexit negotiator Michel Barnier announced last Monday that firms based in Britain will lose their "passporting" rights post Brexit. A "passport" allows fina...

Project Fear scaremongered more about financial services than anything else during the EU referendum campaign and this scaremongering has unfortunately continued after the Brexit vote. Remoaners and soft Brexiteers (those who want us to remain members of the European single market after Brexit) now tell us that the reason why there was not an imme...

[pb_row ][pb_column span="span12"][pb_heading el_title="Article Sub Title" tag="h4" text_align="inherit" font="inherit" border_bottom_style="solid" border_bottom_color="#000000" appearing_animation="0" ]For the City of London membership of the European Union is a double-edged sword. Here the Bruges Group explains how this important industry can thr...

Contact us

246 Linen Hall, 162-168 Regent Street

London W1B 5TB

Director : Robert Oulds MA, FRSA

Founder Chairman : Lord Harris of High Cross