Bruges Group Blog

In December 2025, Ursula von der Leyen had her summer clothes packed for a trip to Brazil. After twenty plus years the EU Mercosur (Argentina, Bolivia, Brazil, Paraguay, Uruguay) FTA had at last been agreed. Except, it wasn't. In the weird world of the EU, the old saying "There's many a slip twixt cup and lip" comes into its own. Members of the EU,...

Much ink has been spilt in recently over what would have happened to the economy if Britain had voted to remain. For all the publicity this has generated, this question is purely academic. As fans of 90's films Sliding Doors and The Butterfly effect can attest, when you make even one tiny change to your starting conditions, what comes next is total...

he EU's shadow borrowing has continued to increase, and rapidly. That is the message given by this high-level update by Bob Lyddon, international banking expert and author of 'The shadow liabilities of EU Member States, and the threat they pose to global financial stability', which was published by The Bruges Group in 2023 and used year-end 2...

What's the best way to destroy a project? The simple answer is to put a person or persons in charge who hate and are totally opposed to that project—that way failure is assured. From the 1st February 2020, the very first day Britain was officially set free from the EU's bureaucratic clutches, there were claims that Brexit was not working even befor...

"Finished", "stuffed", "toast" . These have been the words and worse that many otherwise loyal Conservatives used about their own party recently. However, now that the election has been called in spite of such pessimism, there is hope for the beleaguered Tories.: A week is a long time in politics, said Harold Wilson, so how much longer a...

How to destroy a country may not be an everyday item on the minds of many as they go about their daily lives. Most people living in this country have other things to to think about such as their jobs or juggling the household finances, a big question may be, if they lash out on a treat will they have enough money left to pay the rent or the mortgag...

A year ago, I wrote suggesting that many of the current Conservative MPs would rue the day they ditched Boris. The blog was published in October 2022, and identified three key reasons why people had voted Conservative in the 2019 election: (1) Boris's call to 'get Brexit done' – this reflected the national mood when 'leave' won the referendum in 20...

Germany is a relatively young country. Created as a 'Customs Union' it quickly became an Empire as Bismark consolidated power through a war with France. In 1871 all members of the Zoll Union became provinces of the Empire, with the exception of Luxembourg whose ruling Duke opted out. Bismarck introduced reforms such as health insurance, but mainly ...

The National Interest Advancing freedom, Brexit, and the British national interest. Speakers include;Sir Christopher Chope MP, Bernard Connolly, Barry Legg, Barney Reynolds, The Rt Hon. the Lord Lilley, PC and Sir Bill Cash MP. Location:Pall Mall Room, Army & Navy Club36-39 Pall Mall, St. James's, London SW1Y 5JN Speakers ...

The chief executive of Deutsche Bank Christian Sewing told a meeting in Frankfurt "We are not the sick man of Europe. But, it is also true that there are structural weaknesses that hold back our economy and prevent it from developing its great potential. And we will become the sick man of Europe if we do not address these structural issues now." Ac...

Contrary to the Daily Telegraph's story today claiming that Britain's debt pile does not outstrip the EU's, Britain's is far lower, because the EU's is masked by creative accounting. The full extent of the EU's debts and other financial liabilities is detailed in my book recent book 'The shadow liabilities of EU Member States, and the threat they p...

The German Federal Audit Office ('Bundesrechnungshof') has warned that the Bundesbank may need a bailout due to losses on the EUR650 billion of bonds it bought as part of the Eurozone's equivalent of Quantitative Easing. The Daily Telegraph reported on this on 26 June. Of course the risk is not for the entire EUR650 billion but for the fraction by ...

The totality of the public sector liabilities of EU and Eurozone member states is clouded in obscurity. The key measure tracked by Eurostat - 'General government gross debt' – is circumvented to such an extent that, based on year-end 2021 figures, debts of around €6.4 trillion failed to be registered, and contingent liabilities of around €3.8 trill...

The EU member states contain numerous public sector entities with borrowing powers, and whose debts fall outside the definition of member state debt as reported by Eurostat. The responsibility for the debts tracks back, one way or another, to the member state but the amounts involved are opaque. All that can be said with complete certainty is that ...

EU authorities have permitted commercial banks to implement a particularly aggressive form of risk-evaluation methodology, the result of which is the ability to claim a thick loss-absorption cushion and to attest that the EU banking system is stable and resilient. It isn't: cushions are as thin as before the Eurozone financial crisis. This is laid ...

The Eurosystem has expanded its operations well beyond what a central bank would have traditionally undertaken. It now owns assets that are not 'central bank money' definitionally. Assets have credit ratings as low as BB in the Standard and Poor's system, which means they are 'Speculative Grade' and involve 'Substantial credit risk'. It does not ev...

TARGET2 harbours risks even greater than the enormous ones acknowledged by the European Central Bank

There has been long and ongoing debate about the nature of the sizable loans and deposits that the Eurozone national central banks (NCBs) run with one another within the TARGET2 payment system. The debate has overlooked that the balances are nearly double what the European Central Bank (ECB) reports, and that the report only shows the amounts at th...

The programmes of the European Central Bank (ECB) are extensive, and involve greater risks than the ECB can bear, it being very thinly capitalised. Even modest losses on its programmes would require it to be recapitalised by its Eurozone shareholders – the national central banks (NCBs) of the Eurozone member states. This is laid out in the newly-re...

Net Zero is proving to be a good cover story for the European Investment Bank Group to create huge financial liabilities for the EU taxpayer. The amount looks set to exceed €1.2 trillion by the end of the current EU budget period in 2027. This is laid out in the newly-released book 'The shadow liabilities of EU Member States, and the threat they po...

The European Stability Mechanism is the main bailout mechanism behind the Euro. Croatia recently joined it upon adopting the Euro. The ESM uses two accounting tricks to make it appear larger and more robust than it actually is, disguising that it lacks the firepower to deal with a major incident. This is laid out in the newly-released book 'The sha...

The structures of the EU and Eurozone have allowed the creation of a series of supranational entities that have taken on debts whilst having little financial strength of their own: their creditworthiness depends on guarantees or capital calls from member states, without the extent of the member states' liabilities being transparent and being added ...

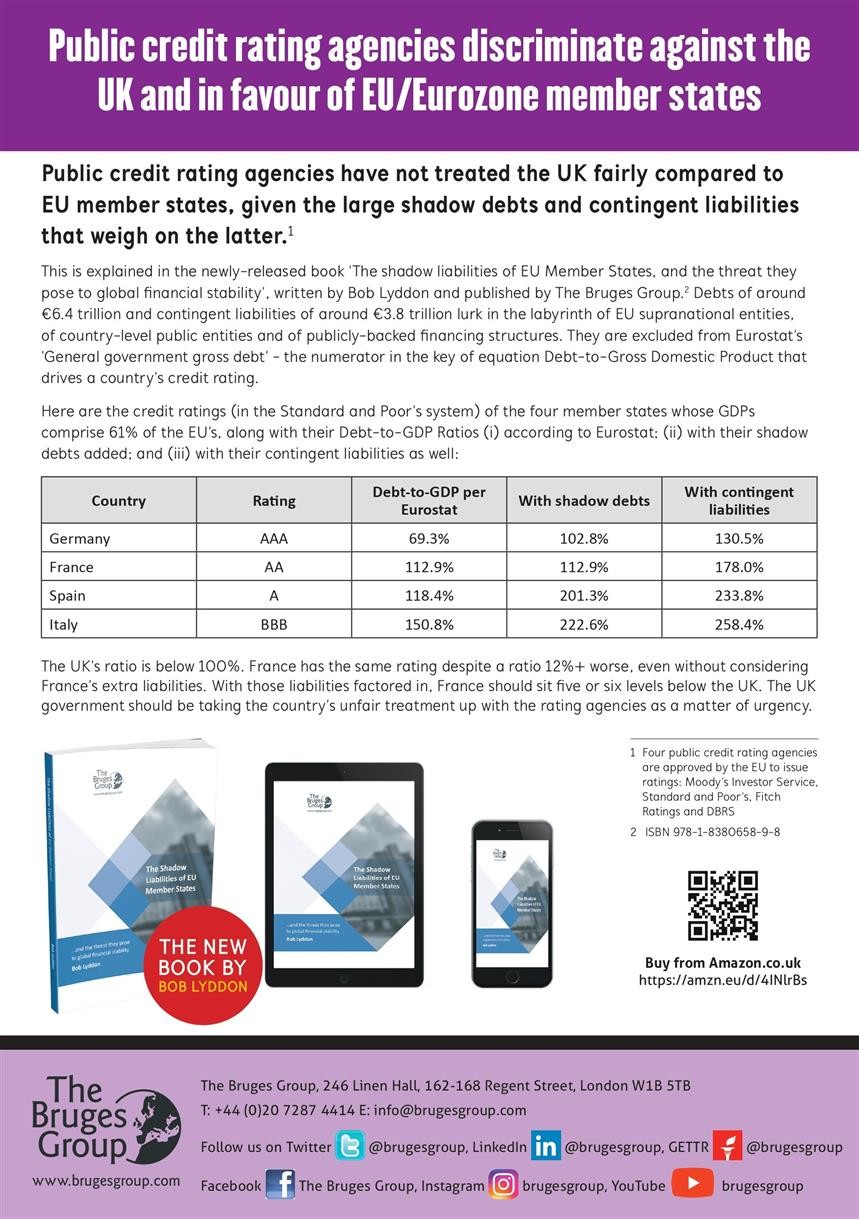

Public credit rating agencies discriminate against the UK and in favour of EU/Eurozone member states

Public credit rating agencies have not been even-handed in their treatment of the UK compared to EU member states, given the large shadow debts and contingent liabilities that weigh on the latter. This is explained in the newly-released book 'The shadow liabilities of EU Member States, and the threat they pose to global financial stability', writte...

The public credit ratings of EU/Eurozone member states are inflated, because the credit rating agencies have not factored in the significant shadow debts and other financial liabilities bearing down on the respective member state's debt service capacity. Total financial liabilities are much higher than these agencies appear to recognise. This is th...

Global debt markets appear comfortable to absorb all of the bonds issued by the European Union for its €750 billion Coronavirus Recovery Fund on the basis that 'it all tracks back onto Germany'. This is true: the guarantee structure behind the EU's debts makes each member state liable for the entirety of them. The same debt markets do not seem to h...

The EU and its member states position themselves as a cornerstone of the rules-based international order, but they break its financial rules in both letter and spirit by failing to fully report their financial liabilities. The key measure tracked by Eurostat - 'General government gross debt' – is circumvented to such an extent that, based on year-e...

EU and Eurozone member states fail to fully report their financial liabilities. The key measure tracked by Eurostat - 'General government gross debt' – is circumvented to such an extent that, based on year-end 2021 figures, debts of around €6.4 trillion failed to be registered, and contingent liabilities of around €3.8 trillion. This discrepancy is...

EU and Eurozone member states fail to fully report their financial liabilities. The key measure tracked by Eurostat - 'General government gross debt' – is circumvented to such an extent that, based on year-end 2021 figures, debts of around €6.4 trillion failed to be registered, and contingent liabilities of around €3.8 trillion. This discrepa...

BUY THIS BOOK &...

The EU likes to sell itself as the high priests of the 'rules-based' system, as the bedrock of financial stability worldwide. So much so that 'stability' was one of the main arguments of the remain side back in 2016 - and remains a prominent argument for rejoining today. In this Bruges Group publication, "The shadow liabilities of EU member s...

Contact us

246 Linen Hall, 162-168 Regent Street

London W1B 5TB

Director : Robert Oulds MA, FRSA

Founder Chairman : Lord Harris of High Cross