Bruges Group Blog

he EU's shadow borrowing has continued to increase, and rapidly. That is the message given by this high-level update by Bob Lyddon, international banking expert and author of 'The shadow liabilities of EU Member States, and the threat they pose to global financial stability', which was published by The Bruges Group in 2023 and used year-end 2...

Contrary to the Daily Telegraph's story today claiming that Britain's debt pile does not outstrip the EU's, Britain's is far lower, because the EU's is masked by creative accounting. The full extent of the EU's debts and other financial liabilities is detailed in my book recent book 'The shadow liabilities of EU Member States, and the threat they p...

The German Federal Audit Office ('Bundesrechnungshof') has warned that the Bundesbank may need a bailout due to losses on the EUR650 billion of bonds it bought as part of the Eurozone's equivalent of Quantitative Easing. The Daily Telegraph reported on this on 26 June. Of course the risk is not for the entire EUR650 billion but for the fraction by ...

The totality of the public sector liabilities of EU and Eurozone member states is clouded in obscurity. The key measure tracked by Eurostat - 'General government gross debt' – is circumvented to such an extent that, based on year-end 2021 figures, debts of around €6.4 trillion failed to be registered, and contingent liabilities of around €3.8 trill...

The EU member states contain numerous public sector entities with borrowing powers, and whose debts fall outside the definition of member state debt as reported by Eurostat. The responsibility for the debts tracks back, one way or another, to the member state but the amounts involved are opaque. All that can be said with complete certainty is that ...

EU authorities have permitted commercial banks to implement a particularly aggressive form of risk-evaluation methodology, the result of which is the ability to claim a thick loss-absorption cushion and to attest that the EU banking system is stable and resilient. It isn't: cushions are as thin as before the Eurozone financial crisis. This is laid ...

The Eurosystem has expanded its operations well beyond what a central bank would have traditionally undertaken. It now owns assets that are not 'central bank money' definitionally. Assets have credit ratings as low as BB in the Standard and Poor's system, which means they are 'Speculative Grade' and involve 'Substantial credit risk'. It does not ev...

TARGET2 harbours risks even greater than the enormous ones acknowledged by the European Central Bank

There has been long and ongoing debate about the nature of the sizable loans and deposits that the Eurozone national central banks (NCBs) run with one another within the TARGET2 payment system. The debate has overlooked that the balances are nearly double what the European Central Bank (ECB) reports, and that the report only shows the amounts at th...

The programmes of the European Central Bank (ECB) are extensive, and involve greater risks than the ECB can bear, it being very thinly capitalised. Even modest losses on its programmes would require it to be recapitalised by its Eurozone shareholders – the national central banks (NCBs) of the Eurozone member states. This is laid out in the newly-re...

Net Zero is proving to be a good cover story for the European Investment Bank Group to create huge financial liabilities for the EU taxpayer. The amount looks set to exceed €1.2 trillion by the end of the current EU budget period in 2027. This is laid out in the newly-released book 'The shadow liabilities of EU Member States, and the threat they po...

The European Stability Mechanism is the main bailout mechanism behind the Euro. Croatia recently joined it upon adopting the Euro. The ESM uses two accounting tricks to make it appear larger and more robust than it actually is, disguising that it lacks the firepower to deal with a major incident. This is laid out in the newly-released book 'The sha...

The structures of the EU and Eurozone have allowed the creation of a series of supranational entities that have taken on debts whilst having little financial strength of their own: their creditworthiness depends on guarantees or capital calls from member states, without the extent of the member states' liabilities being transparent and being added ...

Public credit rating agencies discriminate against the UK and in favour of EU/Eurozone member states

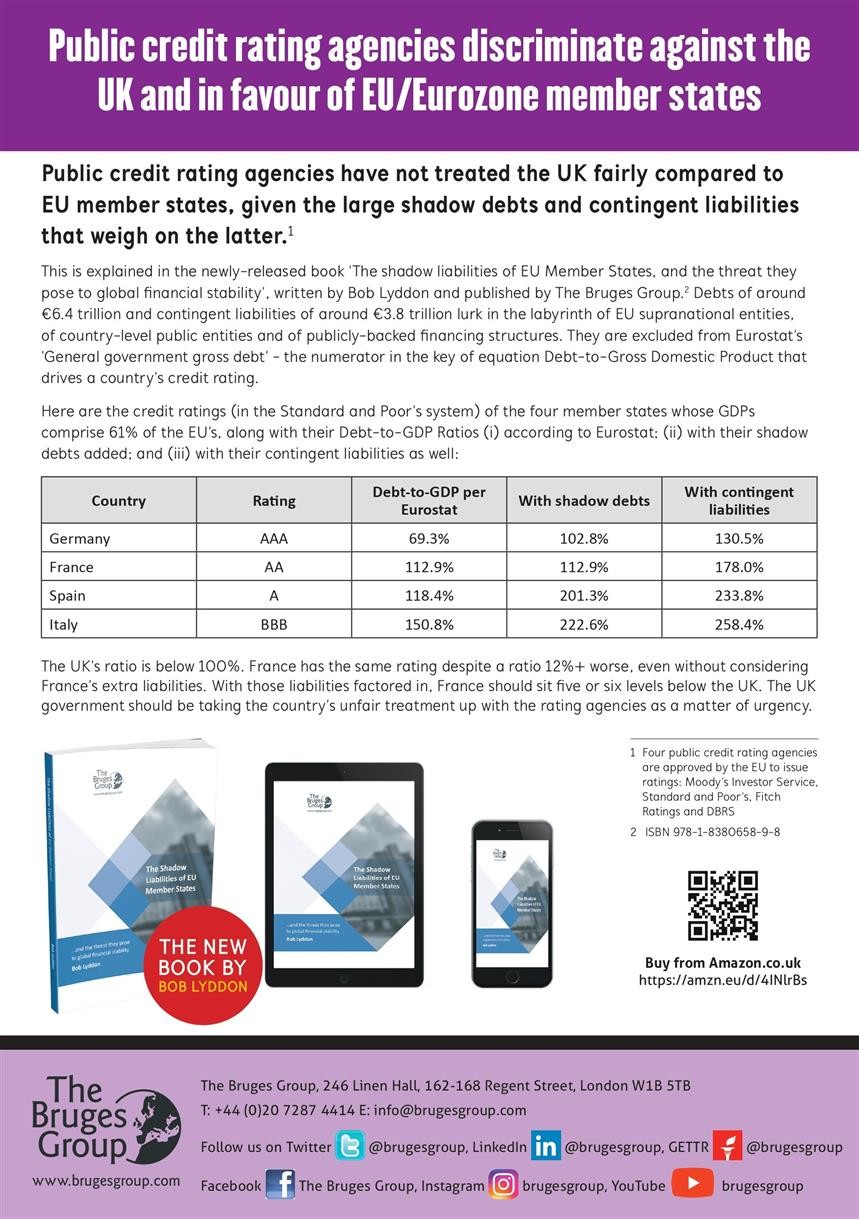

Public credit rating agencies have not been even-handed in their treatment of the UK compared to EU member states, given the large shadow debts and contingent liabilities that weigh on the latter. This is explained in the newly-released book 'The shadow liabilities of EU Member States, and the threat they pose to global financial stability', writte...

The public credit ratings of EU/Eurozone member states are inflated, because the credit rating agencies have not factored in the significant shadow debts and other financial liabilities bearing down on the respective member state's debt service capacity. Total financial liabilities are much higher than these agencies appear to recognise. This is th...

Global debt markets appear comfortable to absorb all of the bonds issued by the European Union for its €750 billion Coronavirus Recovery Fund on the basis that 'it all tracks back onto Germany'. This is true: the guarantee structure behind the EU's debts makes each member state liable for the entirety of them. The same debt markets do not seem to h...

The EU and its member states position themselves as a cornerstone of the rules-based international order, but they break its financial rules in both letter and spirit by failing to fully report their financial liabilities. The key measure tracked by Eurostat - 'General government gross debt' – is circumvented to such an extent that, based on year-e...

EU and Eurozone member states fail to fully report their financial liabilities. The key measure tracked by Eurostat - 'General government gross debt' – is circumvented to such an extent that, based on year-end 2021 figures, debts of around €6.4 trillion failed to be registered, and contingent liabilities of around €3.8 trillion. This discrepancy is...

EU and Eurozone member states fail to fully report their financial liabilities. The key measure tracked by Eurostat - 'General government gross debt' – is circumvented to such an extent that, based on year-end 2021 figures, debts of around €6.4 trillion failed to be registered, and contingent liabilities of around €3.8 trillion. This discrepa...

BUY THIS BOOK &...

Download PDF File Here Mr Sunak's Spring Statement was far less impressive than his rhetoric has made it appear. Once again a senior member of this administration reaches a Gold Standard in rhetoric, but at best a Bronze one in achievement. The claim does not stand up to examination that these were the largest reductions in personal taxation for th...

This new study, issued through The Bruges Group, dissects a main response of the European Central Bank to the pandemic: another programme of bond buying, taking up hundreds of billions of euros of Eurozone member state government bonds into the ECB's Pandemic Emergency Purchase Programme, the "PEPP". The PEPP bought the majority of new debt issued ...

Contact us

246 Linen Hall, 162-168 Regent Street

London W1B 5TB

Director : Robert Oulds MA, FRSA

Founder Chairman : Lord Harris of High Cross