Bruges Group Blog

Does Taxation Have an Upper Limit?

Many of the comments on last week's Budget have pointed out that taxes, already very high, are being pushed higher, and that government borrowing, also very high, is being pushed higher still.

Some commentators are asking – not for the first time – whether the British economy can absorb this amount of taxation and government borrowing, or whether the proposals will be self-defeating, at least in part, in terms of the real net income eventually received by the government.

In other words, does taxation have an economic upper limit?

At least one economist – no less a person than the one who gave us our system of national accounts – did indeed come to the conclusion, many years ago, that there was such a thing as an economic upper limit to taxation in a modern fully developed trading economy.

Back in the 1940s, Colin Clark looked at the statistics for levels of taxation and the annual rate of inflation and concluded that a level of taxation of more than 25% of the 'net national product at current market prices' was likely to produce nothing more useful than inflation.

In other words, the real resources obtained by government for its expenditure on public services and transfers of purchasing power from one group to another would be reduced and not increased.

Naturally, not all economists agree. It depends, to some extent, on how the figures from the national accounts are used and combined. But John Maynard Keynes, in a letter to Colin Clark, is reported to have said: "In Great Britain after the war I should guess that your figure of 25% as the maximum tolerable proportion of taxation may be exceedingly near to the truth. I should not be at all surprised if we did not find a further confirmation in our post-war experience of your empirical law." Clark later confirmed his original result on the basis of post-war estimates from nineteen countries.

In the 1970s, Chicago economist Arthur Laffer sketched out his famous Laffer Curve, and pointed out that the concept had a very long history in economic literature. Laffer's interpretation is often summed up in terms of the incentives for economic behaviour. At low tax rates, the government revenue is insufficient to provide the public services needed by a successful trading economy, but at very high tax rates, the incentive to exchange leisure time for longer working hours and greater personal risk is reduced. Put another way, if taxes are raised too high, people just stop working.

At an Institute of Economic Affairs seminar in London in 1977, Colin Clark stood by his previous position and said: "What cannot, so far as I know, be found is a country with taxation exceeding 25% of the net national income which is not faced with some degree of inflationary pressure."

Clark had framed his hypothesis in terms of general government tax revenue, plus borrowing, in proportion to the Net National Income. As a share of GDP, which for the UK is usually a little larger than the net national income, the upper limit of taxation might have come out an even lower figure.

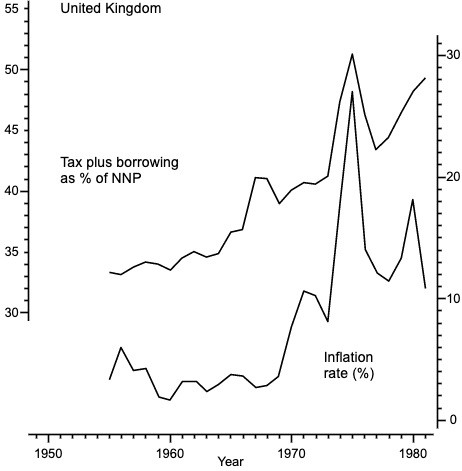

In the 1980s, another less well known economist by the name of Ronald Burgess – for many years an economic adviser to the Bruges Group – repeated Colin Clark's analysis on a more systematic basis. He estimated the economic upper limit for the UK – the point beyond which taxation is no longer absorbed by dispersion throughout the economy, and simply becomes inflationary – at about 30% of the Net National Product. Beyond this point, he suggested, a general rise of costs and prices sets in. This economic upper limit to taxation plus borrowing would not be fixed for all time, he observed, but would depend on many other factors, including the management of the money supply.

These two charts show his analysis for the USA and the UK over the years from 1946 to 1981.

Since then, of course, things have moved on. We are no longer living in the 1940s, the 1970s, or the 1980s, and the British economy of today is very different – unless of course the present government takes us back to the days of 'stagflation' – a stagnant economy, with persistent inflation added.

Rising inflation, of course, brings more people into higher rates of tax, and risks setting in motion a 'taxation-inflation' spiral of economic decline. If this is indeed the prospect that is emerging from last week's Budget, what are the alternatives? Perhaps it is time for some radical new ideas.

Freezing all public sector expenditure in monetary terms for a period of three years would reduce the government's appetite for inflation, whilst creating a breathing space for the economy to recover and grow. Even a little growth could then reduce central government taxation and borrowing as a share of the net national income. Alongside this, perhaps 5% of all income tax receipts could be set aside for the payment of interest on government debt until the economy is restored to health.

Contact us

246 Linen Hall, 162-168 Regent Street

London W1B 5TB

Director : Robert Oulds MA, FRSA

Founder Chairman : Lord Harris of High Cross