Bruges Group Blog

The Alternative to Tax Rises - A Recovery Plan for Britain

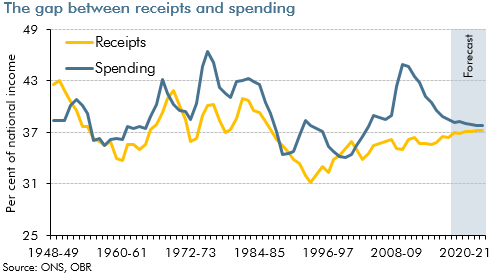

As reported in The Sunday Telegraph last week, and again today, some Treasury officials have been flirting with the idea of tax increases to foot the bill for the COVID measures put in place and for the lockdown that the left and media were so desperately pressuring for. However, according to several media sources, Number 10, Boris Johnson and Dominic Cummings are resisting these plans. The cost of lockdown has not only been economically massive but has also had an astronomical impact on every walk of life, not just the economy, for example, Britons' mental health has drastically worsened due to being cooped up in the house for months on end and that's not even mentioning the people who have life threatening medical conditions which could have been avoided if they had have had them checked out sooner but were often scared into staying at home.

So, back to the proposed tax rises from HMT civil servants, it is absolutely paramount that the Chancellor and his Ministerial team reject flatly these absolutely ridiculous proposals, Boris Johnson and Number 10 are said to be vehemently against the idea of putting up taxes but I would like to put across the case of how we get out of this economic cataclysm without raiding the pay packets of you and I.

Cut Taxes

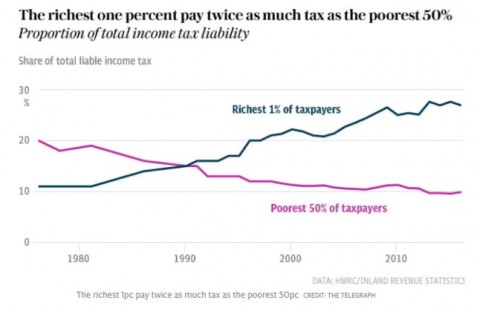

Yes, the exact opposite to what our friends in the metropolitan bubble, that is the civil service, think, it has been proven that when taxes are reduced, the Treasury has taken a greater revenue. For example, when Sir Geoffrey Howe and his successor Nigel Lawson cut taxes between 1979 and 1986, the Treasury took a significantly greater tax revenue than in the late 1970s under a Labour Government, with Denis Healey in Number 11 where the top rate of income tax stood at an eye watering 83pc in 1974 when Harold Wilson defeated Ted Heath in the October general election, with the highest rate of investment income at a staggering 98pc. Howe and Lawson collectively reduced the top rate of income tax to 40pc in the 1988 budget, with the standard rate of income tax being reduced down to 25pc, from what was 33pc in 1979. What does all this mean then? Well, if people are being taxed less, they have more money to spend on themselves and their family, therefore increasing the propensity to consume, subsequently stimulating the economy.

By abolishing the very top income tax band, the additional one created by Gordon Brown's Treasury, which currently sits at 45pc, therefore making the highest band of income tax 40pc, where the current middle rate sits. This alone would generate a potential £1bn of additional income, which isn't much in the grand scheme of things, but it also has a non-fiscal benefit in the sense that it is an incentive to work more. The slashing of the basic rate of income tax (20pc) to 15pc would be a massive token of goodwill from Rishi Sunak, but not only that it will create an additional £15bn of revenue according to Professor Patrick Minford, in his proposals post Coronavirus for The Bruges Group.

The cutting of income tax in the UK, paired with the fast tracking of raising the National Insurance threshold from the current rate of £9,500 per annum to £12,500 p/a, would create a more consumer based economy with more tax receipts collected in indirect taxation such as VAT. Consumer confidence will undoubtedly improve as a result of the tax cuts which will inject a much needed shot of energy into the struggling retail sector, which moves me onto the point.

Business Friendly Policies

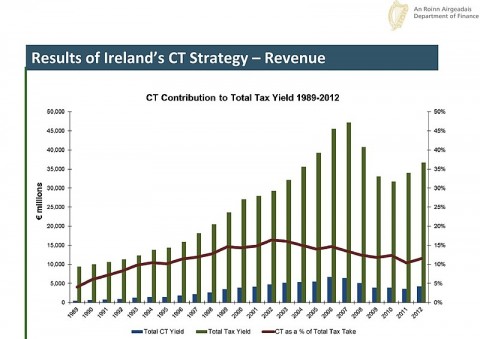

It is absolutely paramount that we introduce more business friendly policies, for a start a cut in corporation tax from 19pc to 12.5pc which would potentially generate the Treasury £24bn, although the fallout from COVID in the way that many businesses are now contracting or going into administration could weaken that figure. However, post virus and post Brexit, the reducing of corporation tax would unquestionably be a huge incentive for outside investment into Britain; just look at the boom which Ireland saw when Charlie McCreevy reduced CT to the same level in 1999.

By introducing more friendly corporation tax strategies such as those introduced in the Republic of Ireland, but also reviewing how business rates are collected and subsequently distributed – there could even be room for business rate holidays for struggling high street firms. With extortionate high street rents matched with quite often extortionate business rates makes it just simply unfeasible for new startups to open branches in town and city centres, contributing to the death of the high street. This is a massive problem as we are after all a nation of shopkeepers, Napoleon meant it as an insult but we Britons take it as a compliment, and the high street and shopping areas are a crucial part of the British way of life, and let's face it, if it is unviable to stay open on the high street or in commercial areas then the knock on effect will be felt in the hospitality sector which has similarly taken a body blow recently, despite the Eat Out To Help Out scheme.

Leaving the EU with No Deal

As the trade talks rumble on, it is looking ever more unlikely that we will leave with a trade deal that suits Britain and our economic needs whether that be financial services or fishing, David Frost is working hammer and tong to get a good trade deal but it just doesn't look likely. As it has been rumoured yesterday, the EU are planning to sideline Chief Negotiator, Michel Barnier, in order to break the deadlock in the crucial trade talks. However, if Frost cannot broker that aforementioned good deal, it would be in our economic and political interest to leave the transition period on 31st December 2020 with no deal – we therefore aren't subject to pay any divorce bills or subject to any EU COVID recovery plans, which will include astronomical bailouts and increased state intervention, as well as more power seeded to the European Commission. Subsequently, a no deal is better than a bad deal, we can save billions by leaving on no deal and moving from there, striking new deals with nations such as the USA, Japan and looking into forming a CANZUK trade arrangement.

Scrap HS2

This week, the first spade eventually went into the ground for building Britain's great train robbery, High Speed 2, this overpriced vanity project is already years behind schedule and tens of billions over budget, estimating the final cost to be the wrong side of £100bn. If so, why don't we halt this taxpayer draining railway at Birmingham? There is little appetite for HS2 north of London quite frankly and the Prime Minister has massively misjudged the mood of the British people and voters in Red Wall seats, this is certainly not levelling up, it is wasting valuable taxpayers' cash on a project that only the Westminster and Whitehall bubbles want.

The other gripe I have with HS2 is of course the environmental impact, ruining swathes of Great British countryside and woodland, but also the diminishing need for such a railway to shave off minutes from a journey; I have a suspicion that we're going ahead with a 20th century solution in the 21st century, the emergence of Zoom meetings during lockdown and the amount of firms moving out of London and around the UK in search of cheaper office space as well as other factors, I just personally don't see a need for such a thing. It may have been an easier pill to swallow had it not cost the taxpayer tens of billions before ground had even been broken or the fact it is going to cost a predicted £108bn to complete, and it doesn't even go further North than Leeds or Manchester – we need to crack on with HS3 across the Pennines and improving our existing rail infrastructure.

Cut Foreign Aid

As the old saying goes, 'trade not aid' and that is exactly the approach we need to be taking in the post-Brexit and post-Coronavirus world. The Treasury recently announced that foreign aid would be cut by £3bn in the next budget, predicted to be presented in the autumn by Rishi Sunak. The merging of the Department for International Development into the Foreign and Commonwealth Office is a welcome step although it did mean that one of the more competent and capable Ministers in Anne-Marie Trevelyan was moved out of the Cabinet. Yes, £3bn does seem a drop in the ocean compared to what is actually spent but it is most certainly a step in the right direction, not only that HMT are scrapping the commitment of 0.7pc of GDP to be spent on foreign aid, a budget which is sitting around the £15bn per annum mark.

Take a Tough Stance on Illegal Immigration

The topic on most people's tongues at the moment, especially on the right wing of the political spectrum, and it is one of the most burning issues of this government – how we deal with costly illegal immigration. What we need to do is take a zero tolerance stance to it, that includes sending illegal migrants back to France or Spain or indeed wherever they've come from; more often than not these people are economic migrants rather than genuine refugees from war torn countries. At the moment, Priti Patel, the Home Secretary, has been saying all the right things but action is lacking, although we must understand that her hands are tied whilst Britain remains in the EU transition period. Once we have left the transition period on 31st December 2020 I have full confidence in the Witham MP to crack down on illegal immigration into Britain; Nigel Farage recently has been highlighting the first class treatment illegal immigrants receive when they arrive on our shores, this must be stopped and it'll save the taxpayer millions of hard earned pounds.

Post-Brexit we can eventually have a fairer, more equitable immigration system, like the one Australia has, a points based one. We should embrace immigration but only immigration that will benefit the British economy, satisfying the laws of the supply and demand of employment in the UK economy.

Abandon the 2050 Carbon Neutral Target

This policy is absolute lunacy at its finest, the policy was one of the final acts of power from Theresa May as Prime Minister and has been championed by Boris Johnson and his eco-Conservative fiancé, Carrie Symonds. However, the policy is nowhere near on track and we should be looking at improving energy efficiency and innovating technology to create a greener solution rather than crippling the economy to hit this rather foolish target. Yes, it is much better than the Green Party's and Extinction Rebellion's 2030 and 2025 net zero target respectively, but it is still something which we shouldn't harpoon an already fragile economy with.

Post-Brexit, Britain could become a world leader in green technology, therefore the target may be reached but we should not pressure ourselves to achieve something just for the sake of saying "we met our target". Eco homes, more efficient and environmentally friendly energy sources, carbon capture coal mining, better eco-friendly technology in the transport sector – these are all fields Britain could be leading the world in post-Brexit if we put our minds to it and encourage start-up firms, green entrepreneurship and investment from the private sector and abroad into those industries. This would be completely different and without question a better move than crippling the economy with taxes on 'non-environmentally friendly' goods and services.

Contact us

246 Linen Hall, 162-168 Regent Street

London W1B 5TB

Director : Robert Oulds MA, FRSA

Founder Chairman : Lord Harris of High Cross